Guyana Focus

Guyanese have a growing appetite for foreign foods – a problem which stifles the development of local industries, threatens food security, and contributes to a higher trade deficit.

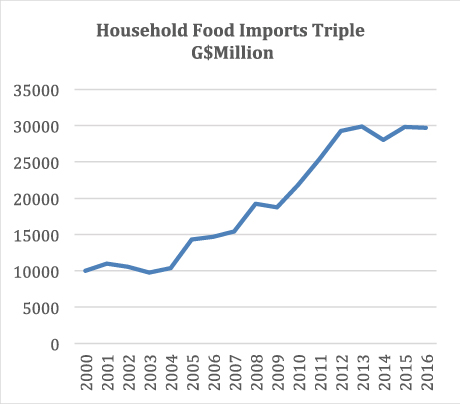

The country’s household food import bill has tripled since the turn of the century – growing from G$10 billion in 2000 to G$30 billion at the end of 2016. (See Chart: Household Food Imports Triple). It’s ironic that food imports has risen steadily in a country which has the greatest agricultural potential in the region and often labeled as the “food bowl of the Caribbean.”

Although oil is currently top of mind among politicians, the government recognizes that agriculture cannot be sidelined. Incidentally, both the World Bank and the IMF see a future for Guyana that is tied to agriculture – a view that has only in recent years influenced the government to revisit its commitment to the sector.

In addition, an IMF assessment of Guyana makes note of the importance of agriculture, stating “Guyana’s future economic growth and poverty reduction depend heavily on agriculture and rural development.”

While the government appears to have a strategic focus on increasing food production, its efforts have evidently not resulted in a decrease in demand for foreign foods.

Evidently, there is a divergence between the composition of domestic food supply and the composition of domestic food demand; and a preference for foreign foods which are perceived to be of better quality and often more convenient to use largely because of packaging and availability characteristics.

Although the quality of some local packaged products might be of equivalent or better quality, the perception that foreign standards are higher also drives foreign food consumption.

This established trend has been addressed repeatedly since food import bans imposed by the late Forbes Burnham were lifted in the 1980s. Nonetheless, no firm initiatives have been implemented to stem the flood of foreign goods, allowing Guyanese to live in the belief that “foreign is better”.

Obviously, the primary challenge would be to deal with resistance from a population that loves foreign goods, whether or not they are of better than locally produced goods.

While it might be more palatable to allow Guyanese freedom of choice, the existing conditions give rise to the need for protectionist measures so that local food production can flourish.

It would therefore be necessary to introduce a stricter system of tariffs to discourage foreign food imports, especially for products that have local substitutes or equivalents.

As well, import licences and quotas should be enforced in a similar manner as practiced in developed countries to restrict the importation of certain foreign foods.

Such measures, if fairly implemented, should allow Guyanese to appreciate the true value of local products. Foreign foods would still be available but at a higher price, resulting from higher tariffs. Those who cannot afford the higher prices would naturally turn to local equivalents. Demand and supply fundamentals would then most likely set desired price and quantity levels.

In developing local foods, appropriate quality control measures should be maintained, thereby eliminating the fear that local products are of poorer standard. For this to work there needs to be a massive re-education process, strategically aimed at selling the virtues of local products. And this process should start in schools and spread to the community level.

Additional revenues earned from duties and tariffs on foreign goods should be used to support the development of local industries and promote the consumption of domestic foods.

One problem that has bugged local food manufacturers is the sustainability of supply of inputs. In agro-processing, for instance, this remains the main determinant of both success and failure. Inconsistent or insufficient supply of local inputs creates inefficiency in the manufacturing process, giving rise to the need for more flexible solutions.

Local industries should therefore be developed with this factor in mind, that is, to ensure that they can operate efficiently on an ongoing basis to be able to meet ongoing demand for food.

Another problem is the government’s lack of commitment in supporting and developing the required infrastructure to support local consumption. Although the government has had limited success in promoting the development of non-traditional agriculture, including small scale agro-processing, it is essential for it to develop a comprehensive plan to promote local manufacturing and consumption.

Such plan should take the country’s existing resources into consideration, and then determine how viable industries can be developed around available resources. The approach must be holistic. Haphazardly approaching the issue on an individual investment basis is a recipe for future problems.

In fact, if there is a plan to develop local food-related industries, the government will be in a better position to attract investments in areas that are geared to support local food production.

Decreasing food imports would not only alleviate the balance of payments and trade deficits but can also reduce the cost of living of Guyanese who must pay higher prices for foreign goods with local substitutes.

At a macro level, developing and promoting local equivalents and establishing export-based industries will support the government’s diversification and job creation strategies. as well as allow domestic food-related industries to flourish.

Consumption of local foods can also contribute to lower healthcare costs. It is well established that health conditions such as obesity, diabetes and heart conditions in Guyana and the Caribbean region can be attributed to an increasing reliance on processed foods.

At a more macro level, developing local food production capabilities and developing strategies to promote local consumption would not only benefit the economy but also ensure food security which has been a primary goal among Caribbean countries.

In as much as non-traditional agriculture to increase food supply and for exports has been on Guyana’s agenda for many years, there has been weak integration of implementation efforts, resulting in sporadic ventures that have engendered limited success. In fact, over time there have been more failures than successes in a broad spectrum of agribusinesses, ranging from processing facilities to livestock development.

At the end of the day, there is no reason why Guyana’s food import bill should be increasing. Rather, it should be declining.

Tamesh Lilmohan

BA MBA CPA

FCCA LLB (Hons.)

(Part 5 of 5)

This is the final of a five part treatise entitled “How I envision the operations of Guyana Revenue Authority moving forward”. In the previous articles I addressed the Authority’s statutory functions under the headings of assess and levy revenue, advisory role, public awareness and effective administration. Also, I made several recommendations, some of which the Government is already implementing, although in a piecemeal and reckless manner. Raising and agreeing assessed taxes are considered as half the job done but this will be meaningless and a waste of GRA resources if it is unable to collect. The risk assessment of collection can be grouped into three areas: fees, trust funds and assessments.

Fees, Levies, Duties and Other Charges

This area of the revenue stock should be operated with commercial efficiency like any other well-run business. The quantum charges are spelt out by legislation and Regulations. However, there are some areas that may require valuations issues to be addressed. In all cases the valuation and transaction should be done in a transparent, fair, consistent and timely manner. Lack of transparency and fairness breed suspicion and doubts. Taxpayers will then buck the system and find ways to circumvent the process. It is a well-known fact that officials use delay tactics in order to solicit bribes and kickbacks. These transgressions lead to unfair competitive advantage and general disenchantment. GRA should promote a policy of zero tolerance for bribery and corruption.

Regular assessments are needed to ensure the integrity of the system. Also, portfolio rotation is necessary to thwart collusion. Physical deterrence, such as cameras and supervision are helpful. Statistical analysis can play a key role in identifying holes in the system. For example, there should be a direct relationship between number of international travelers exiting Guyana and the number and dollar amount of Travel Voucher Tax.

Understatement declared for customs can be compensated for in the tax system when these understated amounts are also recorded as the cost/expense in the net income of the business thus increasing the profit of the business and the corresponding income tax. Like many other areas, there needs to be an integrated approach among the different functions of GRA to corroborate evidence and highlight anomaly for further investigation.

Trust funds

The largest source of the revenue stock comes from VAT and PAYE. This is similar to most countries. They represent funds collected on behalf of the government and therefore the collectors hold these funds in trust with all the regular fiduciary duties attached to trust funds. These collectors act as third parties and strong legislation may be needed to hold them accountable, especially where fungible and personal assets are involved. Some measures to enforce collection would include:

- Hold directors of companies jointly and severally liable

- Proceed with collection actions without resort to the courts (appropriate powers should be available) against the businesses and the “trustees” personal assets

- Withhold and set-off refunds to trustees and to their other business interests where there is failure to collect, file and remit

- Willful failure to collect, file and remit on a timely basis will lead to penalties and criminal charges

- Establish special provisions to take urgent measures where trustees are suspected of taking actions to circumvent collection by transfer/sale/loss/relocation/declaration of bankruptcy or other disposition of business or personal assets; particular attention should be given to non-arms’ length transactions

- May want to seek court order to take immediate collection where collection is in jeopardy

- Timely assessment and collection actions are key; GRA must be pro-active

GRA’s education program should promote the culture that it is morally reprehensible and illegal for those entrusted with these funds to siphon it off when they have been paid by individuals and businesses through their hard earned dollars.

Assessed taxes

Raising tax assessments from voluntary filings or GRA’s self-assessments are no guarantee that the taxes will be collected. The risk of under-collecting must be assessed and measures put in place to address all collection compliance weaknesses. Some tools of recovery would include:

- Applicable measures as mentioned above

- Set up payment arrangements on basis of affordability to pay based on vetted statement of income/expenses and assets/liabilities

- Minister’s delegated discretion under taxpayer relief provisions to waive/cancel interest and penalties under certain conditions such as financial hardship, natural disaster, serious illness and unreasonable delay by GRA

- Legal action to intercept funds payable by third parties, including employers, business receivables, government departments

- Register certificate of debt in the court; this will have the same force and effect as a judgment obtained from the court; once notified, if debt not paid, obtain order to seize assets and property; advertise and dispose

All collections must be handled with care to ensure that they do not infringe the legal rights of the taxpayer. Measures taken will also be cognizant of the ripple effects such as loss of jobs, curtailment of business and public relations.

If Guyana is to be successful at operating a world class Revenue Authority, it must put in place a team of people that are technically competent, experienced and of the highest integrity. But, ultimately, no Revenue Authority can compensate for a taxation system that is devoid of progressive government policies. I will endeavor to write in the future about the values of a good taxation system, including maximum social advantage, finance of public services, and a fair, transparent and non-discriminatory process with specific reference to Guyana.

The Head of the Special Purpose Unit (SPU) of the National Industrial and Commercial Investments Limited (NICIL), Colvin Heath-London said almost 200 workers have been employed at Enmore aimed at starting operations on March 14, 2018.

“We are currently trying to start Enmore operations with a co-partner- DDL,” Heath-London told a Town Hall meeting of the People’s National Congress Reform organised by that party’s North American Region. “The DDL will be helping the Special Purpose Unit and the government to restart Enmore to produce molasses,” he added.

He added that DDL would help the SPU restart the Enmore Estate at East Coast Demerara to produce molasses aimed at saving the local and Caribbean rum industry. With regards to the Rose Hall-Canje Estate, Heath-London said the factory would not be restarted for the first crop. However, from Saturday, March 3, 2018 more than 197 cane harvesters have been employed to harvest 4,300 hectares of sugar cane at Rose Hall and take it to Albion to also produce molasses for DDL.

He noted that since the closure of the several sugar estates in Guyana, the local and Caribbean rum industries were at risk of closure or reduced operations. “With the advent of the closure of three factories in Guyana, it means several alcohol-producing nations in the region are in the jeopardy of either closure or scaling back operations. It is imperative that Guyana leads the way in maintaining stability of rum production and pharmaceutical production in the region,” he said.

DDL has already said that while Guyana’s total molasses production from the three estates- Uitvlugt, Blairmont and Albion- is pegged at 52,000 tonnes, there would be an 18,000 tonne shortfall in 2018 to satisfy a projected increase in distillery production by a further 25 percent over 2017. DDL said its initial assessment of its distillery production for 2017 shows that is has surpassed projections, with an increase of 30% over 2016.

The Skeldon Factory, he added, was currently undergoing maintenance and would be restarted by March month-end as government seeks to attract a buyer for that property as going concern instead of one that is closed that would have to be sold cheaply. “We cannot sell factories that are not working because you’ll get a salvage price. If the factories are operational you will get an optimum value”, Heath-London said.

He reiterated that the plan by the SPU and the United Kingdom-based PriceWaterhouse Coopers is privatise the estates to investors for sugar production only or along with diversified products.

Government earlier this year closed the Skeldon, Rose Hall, Enmore operations and allowed the broke Guyana Sugar Corporation to retain Albion, Blairmont and Uitvlugt to produce 147,000 tons of sugar for the local and Caribbean markets.

The Guyana Police Force said the robbery occurred at a ranch house at Potocco Creek, Berbice River. Dead are 37-year old Indarjit ‘Danny’ Sham of Betsy Ground Village ,East Canje and 21-year old Amar ‘Punk’ Bissoon of Adelphi Settlement ,East Canje.

“Soon after the lawmen disembarked their boat, they were confronted by the now dead men who discharged several rounds at them ; the officers quickly adapted tactical positions ,returned fire and fatally wounded the men who have been positively identified by the victims as members of the gang who committed the robbery,” police said.

The lawmen said they went to a location where the robbery occurred and found the stolen items in a camouflaged aluminium boat. They are 23 sheep, 15 ducks, one solar panel, one radio,a quantity of rope, and other valuables. The items belong to a 50 year-old businessman of Vryheid,West Canje,Berbice.

Police said they also found one 12- gauge pump action shotgun, one .32 pistol, 11 live cartridges, and five live.32 rounds in possession of the bandits .Also three spent cartridges and a .32 spent shell were retrieved at the scene.

To advertise in ICW call

Call 905-738-5005