Guyana Focus

(Final of 2 parts)

The perception that establishing a sovereign wealth fund (SWF) will prevent Guyana’s sudden oil wealth from being stolen or squandered does not hold water. The underlying issue is not necessarily about setting up a fund structure but more so about the rules and regulations that will govern the SWF once it is established.

Arguably, as with any pool of money, if not managed in a transparent and diligent manner, subject to pre-defined objectives, will leave the door for any

number of improprieties, including misuse, misappropriation, misallocation and corruption. In the case of the SWF, the assets are owned by the government of Guyana. How much money is eventually allocated to the SWF will therefore be dependent on how the government chooses to use the excess oil revenues. This will naturally be linked to development, infrastructural and other domestic initiatives that require funding outside the SWF structure in keeping with budgetary requirements.

Therefore, given that the government will have a free hand to spend its oil revenues, the opportunity for corruption and misallocation is huge, given the historical level of real and perceived corruption and lack of accountability in Guyana.

In reality, it will not be unusual for any government in a country which has over time, had to borrow to fund its development, to use its sudden wealth for real and spurious purposes and to fulfill its political ambitions.

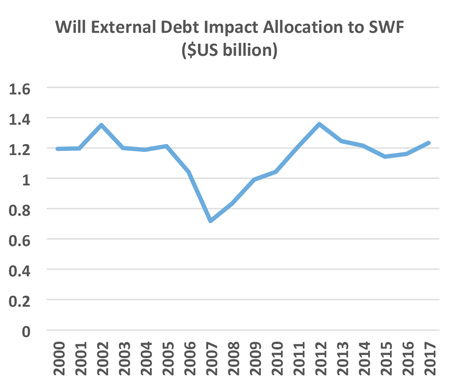

It must also be recognized that Guyana has consistently run budget deficits which it will no longer have, given excess revenues. But more important is the country’s large debt burden which out of prudence it should seek to reduce with its excess revenues. Paradoxically, the country will no longer be a beneficiary of debt write-offs which has kept it afloat over the past two decades or more, meaning that it would have to repay its debt. (See chart)

For argument's sake, if the scope for corruption and squander are eliminated from the equation, then the question comes down to how the SWF is managed. In as much as there are different models in use by various countries, these models only provide guidance on how these countries with different circumstances manage their SWFs. They may or may not be applicable to Guyana’s unique circumstances.

The government will therefore have to tread carefully if it chooses to adopt the SWF model of any specific country. For instance, Guyanese officials earlier this year visited Uganda to obtain a firsthand understanding of the mechanisms that country is employing to manage its oil and gas sector and its SWF. For what it is worth, that must have been a really bad experience. Uganda has no track record running a SWF and is only expected to commence pumping oil in 2018. So it is almost at the same stage as Guyana, and is way worse off than Guyana when it comes to transparency and corruption.

To put this in perspective, in 2017 Transparency International’s Corruption Index ranked Uganda 151, compared to Guyana which has a significantly healthier ranking of 91.

The truth is, there are certain basic principles for managing any SWF. The Santiago Principles, adopted by the International Forum for Sovereign Wealth Funds, are typically applied by most SWFs.

Typically the SWF must be established under a sound legal framework and must have clearly defined investment policies and rules for drawdowns when necessary to prevent abuse. Its governance structure must be independent from the government, transparent and accountable. Management roles and responsibilities must be clearly defined and rules for appointing any associated governing bodies must be established and maintained to prevent government interference.

Members of the SWF board must comprise qualified professionals who are not appointed by the government to prevent incompetence and facilitate comprehensive oversight. There is no scope for political appointments on the board.

The SWF must produce periodic as well as annual reports and have independent auditors. Any activities that are outsourced by the fund must be subject to rules that are applied across the board to prevent nepotism, corruption and favoritism.

Selection of managers for the fund must be based on comprehensive due diligence that takes into account their qualifications, experience and track record. In the real world, manager selection can be subject to less than transparent processes that border on corruption.

The underlying outcome is for the fund to be managed in a manner that will generate the highest possible risk-adjusted rate of return. Achieving competitive performance results will be directly correlated to the asset allocation strategy of the fund, which will in turn be linked to its defined investment mandate. The failure to adhere to the fund’s investment mandate can result in losses.

Ironically, Guyana should note that even well-established SWFs can be subject to poor management which can yield less than desired results, largely because of government interference.

In a December 4, 2017 Bloomberg News article, “How Not to Run a Sovereign Wealth Fund,” it was noted that Norway’s $1 trillion sovereign wealth fund, one of the largest in the world, lagged its peers in performance. The fund’s mediocre performance was largely due to its “third rate governance” caused by government interference. According to Bloomberg: “The Norwegian parliament delegated responsibility for the fund to the finance ministry, which has tasked NBIM, a subsidiary of Norges Bank, with actually running the fund. While NBIM has a staff of more than 500 well-qualified and experienced professionals, it is just 17 finance ministry bureaucrats, with little financial expertise and no market experience, who really call the shots.”

The Norwegian experience echoes what could potentially happen with Guyana’s SWF. There is an appearance of independence on paper but in reality there is no independence.

Regardless of the noise surrounding Guyana’s proposed SWF, it could very well be a decade away before the actual fund is up and running. Under the country’s revenue sharing agreement, 75 percent of oil production will initially be allocated to “cost recovery” to ExxonMobil and its partners. The remaining 25 percent which is considered “profit oil” will be shared 50-50 with the government. The negotiated royalty of 2 percent on gross earnings will bring the government’s initial share of total oil revenues to 14.5 percent, which might not be sufficient to fund the government’s development agenda as well as make allocations to the SWF.

It will not be until the late 2020s before the government’s share of revenues will increase substantially, that is, once cost recovery on the initial investment is met and most of production becomes “profit oil.”

In reality, it will not be unusual for any government in a country which has over time, had to borrow to fund its development, to use its sudden wealth for real and spurious purposes and to fulfill its political ambitions.

It must also be recognized that Guyana has consistently run budget deficits which it will no longer have, given excess revenues. But more important is the country’s large debt burden which out of prudence it should seek to reduce with its excess revenues. Paradoxically, the country will no longer be a beneficiary of debt write-offs which has kept it afloat over the past two decades or more, meaning that it would have to repay its debt. (See chart)

For argument's sake, if the scope for corruption and squander are eliminated from the equation, then the question comes down to how the SWF is managed. In as much as there are different models in use by various countries, these models only provide guidance on how these countries with different circumstances manage their SWFs. They may or may not be applicable to Guyana’s unique circumstances.

The government will therefore have to tread carefully if it chooses to adopt the SWF model of any specific country. For instance, Guyanese officials earlier this year visited Uganda to obtain a firsthand understanding of the mechanisms that country is employing to manage its oil and gas sector and its SWF. For what it is worth, that must have been a really bad experience. Uganda has no track record running a SWF and is only expected to commence pumping oil in 2018. So it is almost at the same stage as Guyana, and is way worse off than Guyana when it comes to transparency and corruption.

To put this in perspective, in 2017 Transparency International’s Corruption Index ranked Uganda 151, compared to Guyana which has a significantly healthier ranking of 91.

The truth is, there are certain basic principles for managing any SWF. The Santiago Principles, adopted by the International Forum for Sovereign Wealth Funds, are typically applied by most SWFs.

Typically the SWF must be established under a sound legal framework and must have clearly defined investment policies and rules for drawdowns when necessary to prevent abuse. Its governance structure must be independent from the government, transparent and accountable. Management roles and responsibilities must be clearly defined and rules for appointing any associated governing bodies must be established and maintained to prevent government interference.

Members of the SWF board must comprise qualified professionals who are not appointed by the government to prevent incompetence and facilitate comprehensive oversight. There is no scope for political appointments on the board.

The SWF must produce periodic as well as annual reports and have independent auditors. Any activities that are outsourced by the fund must be subject to rules that are applied across the board to prevent nepotism, corruption and favoritism.

Selection of managers for the fund must be based on comprehensive due diligence that takes into account their qualifications, experience and track record. In the real world, manager selection can be subject to less than transparent processes that border on corruption.

The underlying outcome is for the fund to be managed in a manner that will generate the highest possible risk-adjusted rate of return. Achieving competitive performance results will be directly correlated to the asset allocation strategy of the fund, which will in turn be linked to its defined investment mandate. The failure to adhere to the fund’s investment mandate can result in losses.

Ironically, Guyana should note that even well-established SWFs can be subject to poor management which can yield less than desired results, largely because of government interference.

In a December 4, 2017 Bloomberg News article, “How Not to Run a Sovereign Wealth Fund,” it was noted that Norway’s $1 trillion sovereign wealth fund, one of the largest in the world, lagged its peers in performance. The fund’s mediocre performance was largely due to its “third rate governance” caused by government interference. According to Bloomberg: “The Norwegian parliament delegated responsibility for the fund to the finance ministry, which has tasked NBIM, a subsidiary of Norges Bank, with actually running the fund. While NBIM has a staff of more than 500 well-qualified and experienced professionals, it is just 17 finance ministry bureaucrats, with little financial expertise and no market experience, who really call the shots.”

The Norwegian experience echoes what could potentially happen with Guyana’s SWF. There is an appearance of independence on paper but in reality there is no independence.

Regardless of the noise surrounding Guyana’s proposed SWF, it could very well be a decade away before the actual fund is up and running. Under the country’s revenue sharing agreement, 75 percent of oil production will initially be allocated to “cost recovery” to ExxonMobil and its partners. The remaining 25 percent which is considered “profit oil” will be shared 50-50 with the government. The negotiated royalty of 2 percent on gross earnings will bring the government’s initial share of total oil revenues to 14.5 percent, which might not be sufficient to fund the government’s development agenda as well as make allocations to the SWF.

It will not be until the late 2020s before the government’s share of revenues will increase substantially, that is, once cost recovery on the initial investment is met and most of production becomes “profit oil.”

from developers

(Stabroek News) – The Central Housing and Planning Authority (CH&PA) has won two cases against errant land developers, Minister within the Ministry of Communities Valerie Patterson related, even as she lamented that many persons have been waiting years for a house lot allocation, while developers leave acres unattended.

“We have a number of applications and some of the developers have the lands still there and nothing was done. Some are seeking to resell and some have already done that. We cannot encourage that because the purpose in giving them it was to assist for providing housing,” Patterson told Stabroek News on the sidelines of Parliament on Thursday.

“We have gotten judgment on two of them recently and I don’t want to give the names,” she added, as she explained that the Chief Executive Officer (CEO) of CH&PA, Lelon Saul, has that information and would elaborate.

This newspaper was unable to ascertain who the two developers are as Saul’s office promised to check with their legal team and get back to the newspaper today (Monday).

Patterson said that when the ministry partnered with the developers, it was to bring affordable housing to Guyana’s citizenry because CH&PA was not financially capable of undertaking all the infrastructural works needed to make the lands livable.

“We have lots of land that were sold to developers; some never paid, some made part payments, some paid in full. There is an agreement they signed and these lands were given to them for housing projects. The reason being is because of the number of live applications we had and could not do it all. CH&PA cannot [provide] serviced lots and houses for all of the people, so they partnered with these developers, who I am sure we thought would have made the houses available. But they have the lands there doing nothing on them,” Patterson said.

She said that Saul has been actively engaging with developers and discussing their terms of agreements while also working to track down others. “I know that the CEO is involved, he has meetings and so on with some of them …and he has the details of where we are,” she added.

Last October, Saul had told this newspaper that CH&PA would file court cases against those persons who were sold swathes of land on the East Bank Demerara corridor but never developed them. However, he had declined to give the names of any of the persons.

“…before the year ends you will see the agency taking several defaulters (developers) to court; those who have failed to deliver on their promises”, he had said.

Saul had stated that he had written to several of the defaulting developers and subsequently held meetings with them. Some, he informed, have indicated that they are faced with challenges. He said that he has indicated the CH&PA’s willingness to work with those developers to overcome whatever challenges they are faced with.

Besides the 100 acres sold to Brian Tiwarie’s BK International Inc (Sunset Lakes Inc), 50 acres were sold to Buddy’s Housing Development, 14 to Dax Contracting Service Incorporated, 25 to Nabi Construction Incorporated, 50 to Cumberland Developers Inc., 25 to Vikab Engineering Consultants Ltd, and 28.8 acres went to Luxury Realty Inc.

All of those lands are located at Providence and were bought in 2011 with the exception of Luxury Realty Inc., which purchased its lands in 2013.

According to documentation seen by this newspaper, 25 acres in the Peter’s Hall area were sold to Kishan Bacchus Construction, while 50 acres of land were sold in the same area to Caricom General Insurance Company Inc, which purchased an additional 25 acres in 2014.

Navigant Builders Inc. and Windsor Gardens Inc. were also sold parcels of land in the Peter’s Hall area. In 2012 and 2014, 25 and 15 acres, respectively, were acquired by Navigant Builders Inc., while Windsor Forest Inc. acquired 40 acres.

Queensway was sold 35 acres of land at Block 22 A, Block Y Golden Grove. This newspaper was unable to ascertain in which year the purchase was made.

A total of six developers purchased land in the Little Diamond/Great Diamond area. Queensville Housing acquired 12.5 acres; A&R Jiwanram Printery Inc., 7.64 acres; RayDan Housing Enterprise, 16.9 acres; Hi Tech Construction Inc., 20 acres; and Romel Jagroop General Construction Services, 12.5 acres. All of these purchases were made during the year 2014.

Last on the list was Mohamed’s Enterprise, which purchased 14.94 acres of land in the same area in early 2015.

These lands were supposed to be developed for the construction and sale of homes.

Since the APNU+AFC administration took office in May 2015, the 18 developers who bought almost 600 acres of prime housing lands, stretching from Providence to Golden Grove, have been repeatedly warned to get their acts together and to honour the agreements that they had signed with the CH&PA.

“We have a number of applications and some of the developers have the lands still there and nothing was done. Some are seeking to resell and some have already done that. We cannot encourage that because the purpose in giving them it was to assist for providing housing,” Patterson told Stabroek News on the sidelines of Parliament on Thursday.

“We have gotten judgment on two of them recently and I don’t want to give the names,” she added, as she explained that the Chief Executive Officer (CEO) of CH&PA, Lelon Saul, has that information and would elaborate.

This newspaper was unable to ascertain who the two developers are as Saul’s office promised to check with their legal team and get back to the newspaper today (Monday).

Patterson said that when the ministry partnered with the developers, it was to bring affordable housing to Guyana’s citizenry because CH&PA was not financially capable of undertaking all the infrastructural works needed to make the lands livable.

“We have lots of land that were sold to developers; some never paid, some made part payments, some paid in full. There is an agreement they signed and these lands were given to them for housing projects. The reason being is because of the number of live applications we had and could not do it all. CH&PA cannot [provide] serviced lots and houses for all of the people, so they partnered with these developers, who I am sure we thought would have made the houses available. But they have the lands there doing nothing on them,” Patterson said.

She said that Saul has been actively engaging with developers and discussing their terms of agreements while also working to track down others. “I know that the CEO is involved, he has meetings and so on with some of them …and he has the details of where we are,” she added.

Last October, Saul had told this newspaper that CH&PA would file court cases against those persons who were sold swathes of land on the East Bank Demerara corridor but never developed them. However, he had declined to give the names of any of the persons.

“…before the year ends you will see the agency taking several defaulters (developers) to court; those who have failed to deliver on their promises”, he had said.

Saul had stated that he had written to several of the defaulting developers and subsequently held meetings with them. Some, he informed, have indicated that they are faced with challenges. He said that he has indicated the CH&PA’s willingness to work with those developers to overcome whatever challenges they are faced with.

Besides the 100 acres sold to Brian Tiwarie’s BK International Inc (Sunset Lakes Inc), 50 acres were sold to Buddy’s Housing Development, 14 to Dax Contracting Service Incorporated, 25 to Nabi Construction Incorporated, 50 to Cumberland Developers Inc., 25 to Vikab Engineering Consultants Ltd, and 28.8 acres went to Luxury Realty Inc.

All of those lands are located at Providence and were bought in 2011 with the exception of Luxury Realty Inc., which purchased its lands in 2013.

According to documentation seen by this newspaper, 25 acres in the Peter’s Hall area were sold to Kishan Bacchus Construction, while 50 acres of land were sold in the same area to Caricom General Insurance Company Inc, which purchased an additional 25 acres in 2014.

Navigant Builders Inc. and Windsor Gardens Inc. were also sold parcels of land in the Peter’s Hall area. In 2012 and 2014, 25 and 15 acres, respectively, were acquired by Navigant Builders Inc., while Windsor Forest Inc. acquired 40 acres.

Queensway was sold 35 acres of land at Block 22 A, Block Y Golden Grove. This newspaper was unable to ascertain in which year the purchase was made.

A total of six developers purchased land in the Little Diamond/Great Diamond area. Queensville Housing acquired 12.5 acres; A&R Jiwanram Printery Inc., 7.64 acres; RayDan Housing Enterprise, 16.9 acres; Hi Tech Construction Inc., 20 acres; and Romel Jagroop General Construction Services, 12.5 acres. All of these purchases were made during the year 2014.

Last on the list was Mohamed’s Enterprise, which purchased 14.94 acres of land in the same area in early 2015.

These lands were supposed to be developed for the construction and sale of homes.

Since the APNU+AFC administration took office in May 2015, the 18 developers who bought almost 600 acres of prime housing lands, stretching from Providence to Golden Grove, have been repeatedly warned to get their acts together and to honour the agreements that they had signed with the CH&PA.

Georgetown – Chairman of the Guyana Elections Commission (GECOM), James Patterson on Saturday underscored the importance of trained polling day staff to deliver free and fair elections. “One of the functions that must permeate GECOM and those who function in it, as for example you, is that you have to see that elections are run free and fair,” he told the opening of a two-day train-the-trainers workshop at the Cyril Potter College of Education (CPCE).

Patterson said although Guyana is “in its infancy” as an independent country, the country was not doing too badly compared to violence-torn Mexico where 130 politicians were recently killed.

“Democracy and free and fair elections are like conjoined Siamese twins. You can’t get one without the other,” he said, adding that that such qualities depend on polling day staff trainers.

The GECOM Chairman’s reference to free and fair elections came against the background of recent concerns by the opposition People’s Progressive Party (PPP) that a plan was probably being hatched to rig the 2020 general elections. The PPP has cited, among other things, President David Granger’s unilateral appointment of the GECOM Chairman, despite the submission of three lists of six names each. The High Court has since upheld the constitutionality of Patterson’s appointment, but the PPP has moved to the Court of Appeal.

A GECOM official told the news media that 374 persons were shortlisted from 612 applicants to pursue the in-house training. From that number, 80 would be selected to train polling day staff. On Saturday, 124 persons were expected to attend the workshop at CPCE and 94 at Lodge Secondary School.

Among the subject areas that participants are being trained in to train polling day staff are nomination day activities such as criteria, defects/corrections of lists of nominees, approval/non-approval of lists, appeal against non-approval of lists, public declaration of lists, and publication of approved lists.

In terms of pre-election day activities, participants are expected to be taught staffing and list of duties, layout of polling stations, proxies and certificates of employment, Disciplined Services balloting, and methodology and sorting of materials for election day.

The training components for election day activities are before and during the poll, authorised persons, the voting process, intermixing of Disciplined Services Ballots, close of poll, after close of poll, the count, recount and resolution of ties.

The subject of Declaration of Results includes election returns verification of election returns, electoral quota, allocation of seats, and election results, while forming part of training on post-election day activities are gazette/publishing of results, election certificate, election reports, and return of election materials.

Patterson said although Guyana is “in its infancy” as an independent country, the country was not doing too badly compared to violence-torn Mexico where 130 politicians were recently killed.

“Democracy and free and fair elections are like conjoined Siamese twins. You can’t get one without the other,” he said, adding that that such qualities depend on polling day staff trainers.

The GECOM Chairman’s reference to free and fair elections came against the background of recent concerns by the opposition People’s Progressive Party (PPP) that a plan was probably being hatched to rig the 2020 general elections. The PPP has cited, among other things, President David Granger’s unilateral appointment of the GECOM Chairman, despite the submission of three lists of six names each. The High Court has since upheld the constitutionality of Patterson’s appointment, but the PPP has moved to the Court of Appeal.

A GECOM official told the news media that 374 persons were shortlisted from 612 applicants to pursue the in-house training. From that number, 80 would be selected to train polling day staff. On Saturday, 124 persons were expected to attend the workshop at CPCE and 94 at Lodge Secondary School.

Among the subject areas that participants are being trained in to train polling day staff are nomination day activities such as criteria, defects/corrections of lists of nominees, approval/non-approval of lists, appeal against non-approval of lists, public declaration of lists, and publication of approved lists.

In terms of pre-election day activities, participants are expected to be taught staffing and list of duties, layout of polling stations, proxies and certificates of employment, Disciplined Services balloting, and methodology and sorting of materials for election day.

The training components for election day activities are before and during the poll, authorised persons, the voting process, intermixing of Disciplined Services Ballots, close of poll, after close of poll, the count, recount and resolution of ties.

The subject of Declaration of Results includes election returns verification of election returns, electoral quota, allocation of seats, and election results, while forming part of training on post-election day activities are gazette/publishing of results, election certificate, election reports, and return of election materials.

Georgetown – The Customs Anti-Narcotic Unit (CANU) is seeking the public’s help to find a Good Hope, East Coast Demerara man, who is wanted for questioning about the recent discovery of almost 325 pounds of cannabis and cocaine in a boat at Mon Repos, East Coast Demerara.

CANU issued a wanted bulletin for Farok Baksh, known as ‘Dive and Shoot,’ whose last known addresses are 91 Pump Road, Mon Repos and 254 North Mon Repos, East Coast Demerara.

An alleged accomplice, Azim Baksh, called ‘Bato,’ of Lot 123 Good Hope, East Coast Demerara, who was arrested following the discovery, is expected to be charged. He is scheduled to appear at the Sparendaam Magistrate’s Court.

Baksh’s wife, who was also detained, remains in custody.Baksh and his wife were arrested on Saturday morning following the discovery of the drugs in a wooden vessel at Mon Repos.

CANU, in a statement, had said that an operation was conducted during the wee hours of Saturday morning and uncovered 82 parcels of cocaine, weighing 91.132 kilogrammes (200.9 pounds) and 98 parcels of cannabis, weighing 56.008 kilogrammes (123.4 pounds). The total 147 kilogrammes of narcotics is equivalent to 324 pounds.

The agency had explained that during the operation, several locations along the East Coast seawall used for the docking of fishing vessels were reconnoitered.

Sometime around 4 am on Saturday, it said, a suspected fishing vessel was seen approaching a docking location in the Mon Repos channel and was intercepted.

At the time, CANU said two suspects were spotted in the boat. Farok was said to be the captain of the boat at the time of the discovery but he managed to escape.

CANU issued a wanted bulletin for Farok Baksh, known as ‘Dive and Shoot,’ whose last known addresses are 91 Pump Road, Mon Repos and 254 North Mon Repos, East Coast Demerara.

An alleged accomplice, Azim Baksh, called ‘Bato,’ of Lot 123 Good Hope, East Coast Demerara, who was arrested following the discovery, is expected to be charged. He is scheduled to appear at the Sparendaam Magistrate’s Court.

Baksh’s wife, who was also detained, remains in custody.Baksh and his wife were arrested on Saturday morning following the discovery of the drugs in a wooden vessel at Mon Repos.

CANU, in a statement, had said that an operation was conducted during the wee hours of Saturday morning and uncovered 82 parcels of cocaine, weighing 91.132 kilogrammes (200.9 pounds) and 98 parcels of cannabis, weighing 56.008 kilogrammes (123.4 pounds). The total 147 kilogrammes of narcotics is equivalent to 324 pounds.

The agency had explained that during the operation, several locations along the East Coast seawall used for the docking of fishing vessels were reconnoitered.

Sometime around 4 am on Saturday, it said, a suspected fishing vessel was seen approaching a docking location in the Mon Repos channel and was intercepted.

At the time, CANU said two suspects were spotted in the boat. Farok was said to be the captain of the boat at the time of the discovery but he managed to escape.

Georgetown – Eight persons are now being questioned and one has since admitted to playing a part in the murders of Pandit Deonarine Liliah, 61, and his son, Gopaul, who were found dead in their Craig Street, Campbellville home between Saturday and Monday of last week.

Guyana Police Force Public Relations Officer Jairam Ramlakhan told the media that the first person who was arrested revealed to investigators that he was in the vicinity of the crime scene. The man reportedly told investigators he and another individual went to the Liliahs’ home but he acted as a lookout.

The other five persons were arrested over the weekend. Meanwhile, the second person who was arrested and detained has been released on station bail, Ramlakhan noted.

The second man to be held, who was arrested last week Wednesday, reportedly had two cell phones belonging to the victims in his possession. He had told police that he bought the phones from a person fitting the description of the suspect who was arrested the day before, hours after the discovery.

The decomposed bodies of the Liliahs, bearing multiple stab wounds, were discovered on Tuesday of last week. Autopsies have revealed that they both died as a result of multiple stab wounds.

It is suspected that the men were killed during a robbery. They were both last seen alive the Saturday before.

While there were no signs of forced entry into the house, investigators have managed to obtain CCTV footage which shows a male scaling the western fence of the house and entering the home through the northern door.

The individual had escaped from the house with two bulky bags and a bucket.

The Liliahs were discovered after their tenant, Leewattie Ganpat, 40, a home aid worker, reported that a strong stench was emanating from the upper flat of the house.

As a result, police went to the house and found the father and son lying in pools of blood.

Deonarine and Gopaul were last seen alive around 6 am on the Saturday by Ganpat, when they had a conversation in the yard. The woman told police that later that night she heard footsteps in the upper flat of the house. At the same time, she said that she was using the internet when it was suddenly abruptly disconnected.

Guyana Police Force Public Relations Officer Jairam Ramlakhan told the media that the first person who was arrested revealed to investigators that he was in the vicinity of the crime scene. The man reportedly told investigators he and another individual went to the Liliahs’ home but he acted as a lookout.

The other five persons were arrested over the weekend. Meanwhile, the second person who was arrested and detained has been released on station bail, Ramlakhan noted.

The second man to be held, who was arrested last week Wednesday, reportedly had two cell phones belonging to the victims in his possession. He had told police that he bought the phones from a person fitting the description of the suspect who was arrested the day before, hours after the discovery.

The decomposed bodies of the Liliahs, bearing multiple stab wounds, were discovered on Tuesday of last week. Autopsies have revealed that they both died as a result of multiple stab wounds.

It is suspected that the men were killed during a robbery. They were both last seen alive the Saturday before.

While there were no signs of forced entry into the house, investigators have managed to obtain CCTV footage which shows a male scaling the western fence of the house and entering the home through the northern door.

The individual had escaped from the house with two bulky bags and a bucket.

The Liliahs were discovered after their tenant, Leewattie Ganpat, 40, a home aid worker, reported that a strong stench was emanating from the upper flat of the house.

As a result, police went to the house and found the father and son lying in pools of blood.

Deonarine and Gopaul were last seen alive around 6 am on the Saturday by Ganpat, when they had a conversation in the yard. The woman told police that later that night she heard footsteps in the upper flat of the house. At the same time, she said that she was using the internet when it was suddenly abruptly disconnected.

To advertise in ICW call

Call 905-738-5005