Guyana Focus

securities sector

First of 2 parts

Recognizing that its’ stock market can play a crucial role in the country’s economic development the Guyana government has announced plans to establish a modern capital markets infrastructure and revamp its regulatory regime.

While the Guyana Stock Exchange (GSE) was established in 1993, this is the first time any government has seriously considered its potential role in economic development and taken steps to modernize its infrastructure to keep

pace with the rapid development of viable stock markets in more than 35 developing countries around the world. Incidentally, the GSE was established in accordance with the objectives of the IMF’s Guyana Poverty Reduction Strategy, with the aim of encouraging and/or supporting the private sector to raise local financing for investment. At that point in time the country was overburdened by debt and its recovery was being supervised by the IMF.

As well, stock markets can be an attractive source of foreign investors who typically seek attractive investments outside their own borders. In the process, they can provide domestic companies with capital to grow their businesses.

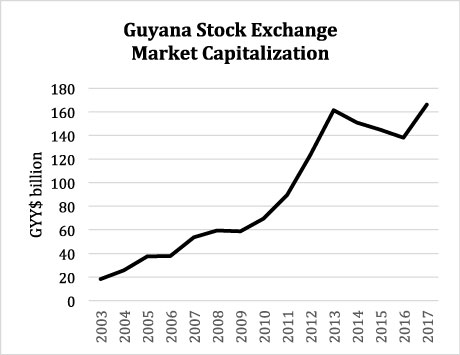

Guyana currently has a small, underdeveloped and relatively illiquid stock exchange, with 16 listed companies which had total market capitalization of GYD$166.2 billion or approximately US$810 million at the end of December 2017.

Since it was established in 2003, the market capitalization of the index has grown by more than 800%, and experienced only three years of moderate decline between 2014 and 2016 (See Table). This means that the listed companies have experienced healthy growth in their stock prices and investors in these companies would have made substantial capital gains, depending on when they invested in individual stocks.

In global terms, Guyana would be classified as a frontier market, that is, markets that are emerging but are not yet classified as emerging markets. Generally, frontier markets are illiquid, have a small number of listed companies and are undercapitalized.

More importantly, their regulatory, legal, disclosure, reporting and trading infrastructure is still evolving, making investment decisions challenging and difficult for global investors. That’s why, unlike developed markets, frontier markets are often categorized as a brave new world for investors willing to take the risk of investing in countries whose stock markets are now at a formative stage of development.

Arguably, while the risk of investing in these markets is greater, the rewards can be significant. Typically, investors who invest in frontier markets like Guyana benefit from what is referred to as the “first mover’s advantage,” that is, they get in when stocks are relatively undervalued and hold their investments for the long-term with the objective of realizing significant gains.

Incidentally, the GSE is well positioned to attract a flood of local and foreign investors should the government successfully implement its plans to modernize its capital market infrastructure.

In its 2018 budget, presented last November, the government noted that a limited number of financial instruments are traded on the GSE and that there are only a small number of participants in the market.

Currently, securities traded on the GSE are all equities and the government hopes to diversify its listings to include equity as well as debt securities. It hopes to develop a bond market and is awaiting the submission of an IMF report.

Typically, tradable bonds may be issued by the government as sovereign bonds or by large domestic corporations.

For foreign investors, bonds may be issued in local or foreign currency, usually the US dollar, British pound or some other major currency. In the global arena, there is a growing tendency for developing markets to issue local currency bonds which reduce the risk of a run on the currency, thereby facilitating currency stability and minimizing systemic risk.

However, while domestic investors might be comfortable with investing in local corporate bonds and government securities, foreign investors pay attention to factors such as a country’s and individual corporation’s credit rating and currency stability. Guyana does not currently have a global credit rating.

Beyond the issue of high-yielding sovereign bonds as a component of its proposed Sovereign Wealth Fund, and the listing of local government securities, it is believed that equity securities will continue to dominate the GSE for years to come. Notwithstanding, there is potential for local corporations to list bonds on the GSE, primarily for investment by domestic investors.

New securities listings may come in the form of initial public offerings by private companies seeking to go public. Arguably, one of the drawbacks of new listings is that Guyanese private corporations tend to be narrowly held and there appears to be a high degree of reluctance to diversify ownership.

In setting the stage for its modernization plans, the government recognizes that the legal and regulatory framework governing the operation of the securities sector has not kept pace with developments with global best practices.

As a result it plans to introduce a modern and comprehensive legislative framework to improve the regulatory regime, enhance investor protection and strengthen cross-border supervision and cooperation among financial regulators, in order to reduce systemic risk.

This will involve rewriting the Securities Industry Act (SIA) by the Guyana Securities Council. According to the budget, the new SIA will address the following areas:

? Improved licensing regimes for self-regulatory organisations, securities exchanges and securities intermediaries;

? Extension of regulatory authority over the entire securities marketplace, including quotation and trade reporting systems and alternative trading schemes;

? Institution of a licensing regime for collective investment schemes;

? Establishment of a Central Securities Depository to record and maintain securities and register the transfer of ownership of securities; and

? Conferral on the regulator (to be renamed the Securities Commission) of such powers and duties as would enable it to promote the orderly development of the securities market and to protect the integrity of the market from abuse.

Evidently, Guyana’s plans to modernize its securities markets infrastructure and its regulatory regime can put the country on the map to become a tradable market for investors globally.

ANALYSIS – Reform of Guyana Revenue Authority

(Second of 5 parts)

In my last article, I alluded to the statutory functions of the Guyana Revenue Authority (GRA). I dealt with the function relating to the effective and efficient administration of the Revenue Authority. Among my recommendations, were the formulation and implementation of a Code of Conduct for all GRA employees, modernization of GRA via the twin pillars of automation and statistics/analytics, and the use of corporate business plan.

Many taxpayers are reluctant to come forward to disclose past (real or perceived) infractions for fear of prosecution, especially in light of the Government’s posturing under organizations like SOCU and SARA. This frightened many to freeze their operations and resulted in massive capital flight out of the country. The Government is embarking on developing new entrepreneurship with Government’s funding and training but this will have a long gestation period. In the meantime, the economy is likely to implode and the new entrepreneurs cannot fill the gap.

While I am aware that GRA has recently implemented an Amnesty for delinquent tax returns, this is a short-term measure and may be motivated by instant cash grab rather than genuine tax compliance. I am proposing that GRA look at a long-term permanent solution by way of implementing a permanent Voluntary Disclosure Programme. This will allow taxpayers to regularize their past ten years’ tax affairs and monitor future transactions. For taxpayers’ genuine voluntary disclosure and cooperation, they will enjoy forgiveness of interest and waiver of penalties, plus immunity from prosecution and anonymity from public knowledge.

Taxpayer’s Bill/Charter of Rights

Among tax authorities it is understood that taxpayers are more likely to comply with their obligations when they are aware of their responsibilities/rights and compliance is not too onerous. A charter of rights will list treatment that taxpayers are entitled to when dealing with Guyana Revenue Authority. These rights will form a social contract, which will serve as a practical guide of the relationship between GRA and the taxpayers. It will include, among other rights the following:

- Pay no more or no less than what the law requires

- Privacy and confidentiality

- Formal review and fair determination of disputes

- Professional, courteous and fair treatment

- Timely attention to matters

- Representation of your choice

- Complete, accurate, clear and timely information

- Lodge service complaint and receive explanation of findings

GRA should make a special commitment to small and micro businesses. These businesses have special needs. Without proper attention they can perish and bring about grave personal and financial hardships to their owners and other interested parties.

Special rights accorded to small and micro businesses would include: commitment of GRA to work with other agencies, including the Ministry of Business and the Registrar of Companies, to streamline the administrative and compliance processes to minimize paperwork and costs, increase efficiency and make businesses more competitive. An integrated single-module VAT and income tax system, driven by revenue documentation and verification, should be implemented for these businesses.

In the broadest sense, GRA must play an integral role in reducing the social acceptability of participating in activities that avoid taxes and circumvent the tax laws of the country, while affording the public, taxpayers and businesses their full rights.

I will address GRA’s advisory role to the Government with respect to international tax arrangements and local revenue matters in a future article.

evaluation of Guysuco’s assets

SPU-NICIL said PwC’s work on the GuySuCo project is expected to last eight months – i.e. until around mid September.

PwC, selected from a field of the top four international financial services providers, was ranked as the most prestigious accounting firm in the world for the last seven consecutive years.

NICIL and PwC signed the agreement on Friday, January 12, 2018, and work commenced with meetings with the SPU team at their LBI Offices. The PwC team will be carrying out the valuation of all assets under the control of GuySuCo, and develop an investment prospectus as part of the consultancy. PwC is also expected to provide other advisory and financial services.

SPU Head, Colvin Heath-London, speaking after the meeting with the PwC team was quoted in a NICIL-SPU statement as saying, “We are encouraged that we were able to get the PwC team in so quickly. With the current developments in the sugarcane sector we are working to bring stability to the industry and affected communities as quickly as possible”.

Heath-London added that, “the work of PwC, given their vast experience in this type of process, will help all decision makers to arrive at the best decisions for the assets of GuySuCo, for other business that are in the GuySuCo supply chain, and most importantly for the workers who are uncertain about their future.”

PWC will be tasked with ensuring a level playing field for all interested parties and stakeholders as the process goes forward. Speaking after meeting the SPU, PwC Caribbean Partner, Wilfred B Baghaloo, said “We look forward to this opportunity of working with Government and the people of Guyana to find a practical economic solution to the privatisation of the three sugar estates on a timely basis. This is indeed a challenging task but we believe that we are equipped with the necessary experience and skills set to ensure a successful project.”

Baghaloo was asked about an article that appeared in the Guyana Times about a PwC incident in India. He replied that, “In respect of the India matter, I cannot comment too much on this as the matter is subject to an Appeal. In summary, the matter relates to a 2009 event relating to a specific company and a specific stock exchange. We continue to service our numerous clients in India and we continue to enjoy their support and confidence. As is it relates to the task at hand in Guyana, our long history of strong commitment to excellence, integrity, innovation and quality will continue.”

Valuation of the Guysuco assets is part of a plan to sell assets at the now closed Skeldon, Rose Hall, Enmore and Wales estates.

Two locally owned companies – Nand Persaud Rice Mills and Demerara Distillers Limited – have expressed interests in taking over Skeldon and Enmore operations respectively. Nand Persaud is optimistic it can revive sugar production at Skeldon while Demerara Distillers Limited wants to use Enmore to satisfy its molasses demand at a time of increasing overseas demand for its rums.

The pre-approved items are outlined in Annex D of the 2016 contract signed between Esso Exploration and Production Limited (ExxonMobil) and the APNU+AFC government.

Minister of Natural Resources, Raphael Trotman signed on Government’s behalf.

Some of the items listed in Annex D can be sourced in Guyana. Also, the need for ATVs for offshore operations is not clear. ExxonMobil, in most instances, states why a specific item is required, but the need for ATVs was not listed.

Annex D is to be applied in harmony with Article 21 of the contract.

Article 21 states that ExxonMobil and all its affiliates engaged in Petroleum Operations shall be permitted to import, free of duty, VAT or all or any other duties, taxes, levies or imposts, all equipment and supplies required for Petroleum Operations including but not limited to drillships, platforms, vessels, geophysical tools, communications equipment, explosives, radioactive sources, vehicles, oilfield supplies, lubricants, consumable items (other than foodstuffs or alcoholic beverages or fuel), as well as all items listed on Annex D.

Interestingly, the long list of items in annex D is not all the oil giant wants to import.

The contract states: “The aforementioned items, including but not limited to the items listed on Annex D, shall be deemed approved and certified by the Chief Inspector to be for use solely in carrying out Petroleum Operations. The Contractor shall give prior notification to the Minister of Sub-Contractors engaged in Petroleum Operations.”

Even items that were not listed within Annex D are to be considered pre-approved.

Further, the contract states that each expatriate employee of ExxonMobil or its affiliates who have been assigned to work in Guyana will be given duty free as well.

The contract states, “…Subject to the limitations and conditions set out in the Customs Act, to import into Guyana free of import duty and taxes within six (6) months on first arrival his personal and household effects including one (1) motor vehicle, provided, however, that no property so imported by the employee shall be sold by him in Guyana except in accordance with Government regulations and upon the payment of the prescribed customs duties.

“Any importation or replacement of motor vehicles by Expatriate Employees of the Contractor (including any Affiliated Company) and of Sub-Contractors shall be a matter for consultation with the Minister.”

The contract also states that each expatriate employee of the Contractor (including any Affiliated Company) and of Sub-Contractors shall have the right to export from Guyana, free of all duties and taxes, and at any time, all of the items imported.

As for the company of itself, the contract states: “Any of the items imported into Guyana may, if no longer required for Petroleum Operations hereunder, be freely exported at any time by the importing party, without the payment of any export duty or impost; provided, however, that on the sale or transfer by the importer of any such item to any person in Guyana (other than the Government) import duty shall be payable by the importer on the value thereof at the date of such sale or transfer as determined by the Customs and Excise Department in accordance with their applicable rules.”

“These workers were mainly retained as the sugar company was seeking to provide certain services to the National Drainage and Irrigation Authority (NDIA). Dismayingly, that arrangement has fallen through and the workers are the hapless victims,” the union said in a statement.

It added that the further expansion of the unemployed in the sugar belt is undoubtedly making a really bad situation even worse. “Given the absence of any plans to deal with the fallout from the miniaturisation of the industry and the fiasco that has surrounded the workers severance payment, this furthering retrenchment is heart-rending to say the least,” it added.

The union, which said the process of informing the identified workers would begin sometime soon, with their redundancy becoming effective not too long from now, did not cite a specific number of workers who would be affected.

GuySuCo spokeswoman Audreyanna Thomas said she could only confirm that additional workers were going to be laid off. Thomas added that GuySuCo was still in the process of finalising the list of workers and could not give any more definitive information on the situation, including when the workers are expected to complete their last day as employees of the sugar company. However, Stabroek News reported a source close to the corporation saying the figure stands at around 500 and could even climb higher.

Thomas couldn’t confirm that figure but indicated that there are over 900 employees remaining at the three estates.

On December 31st, 2017 more than 4,000 workers rang in the New Year without jobs. However, despite being owed severance pay, a large majority of the workers had not received their monies, with Minister of Agriculture Noel Holder stating that they would be paid by the end of January.

Last Friday, a supplementary allocation of $1.93 billion was approved to assist with the payment of severance to the workers who were laid off at the end of last year.

To advertise in ICW call

Call 905-738-5005